Niva Bupa Health Insurance sold its shares in the price band of Rs 70-74 apiece, which could apply for a minimum of 200 shares and its multiples thereafter to raise a total of Rs 2,200 crore.

Shares of Niva Bupa Health Insurance debuted softly on Dalal Street on Thursday, listing at Rs 78.50 on the BSE. This price marked a 6.08 percent premium over its issue price of Rs 74.

The listing of Niva Bupa Health Insurance has been above the expectaitons. Ahead of listing, shares of Niva Bupa Health Insurance Company were commanding a grey market premium (GMP) premium of Rs 1, suggesting flat listing for the investors. However, there was almost no activity in the grey market for the majority of the IPO period for the issue.

The IPO of Niva Bupa Health Insurance was open for bidding between November 7 and November 11. It had offered its shares in the price band of Rs 70-74 per share with a lot size of 200 shares. The Delhi-based company raised a total of Rs 2,200 crore via IPO, which included a fresh share sale of Rs 8000 crore and offer-for-sale (OFS) of up to 189,189,189 shares worth Rs 1,400 crore.

Niva Bupa Health Insurance IPO: Subscription Details and Broker Insights

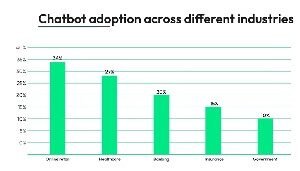

The issue received an overall subscription of 1.80 times. Qualified institutional bidders (QIBs) subscribed to the allocation 2.06 times, while retail investors subscribed 2.73 times to their allocated portion.

Incorporated in 2008, Niva Bupa Health Insurance Company is a joint venture between the Bupa Group and Fettle Tone LLP that provides insurance in the health sector. It offers a holistic proposition by providing customers access to a comprehensive health ecosystem and service capabilities through its Niva Bupa Health mobile application and website.

Brokerages mostly had a positive view on the issue and suggested subscribing for a long term citing. Kotak Mahindra Capital, ICICI Securities, Morgan Stanley India, Axis Capital, HDFC Bank and Motilal Oswal Investment Advisors were the book running lead managers of the Niva Bupa Health Insurance IPO, while Kfin Technologies was the registrar for the issue.